7.99 plus tax

It will be 750 plus 750 x tax rate. Firstly divide the tax rate by 100.

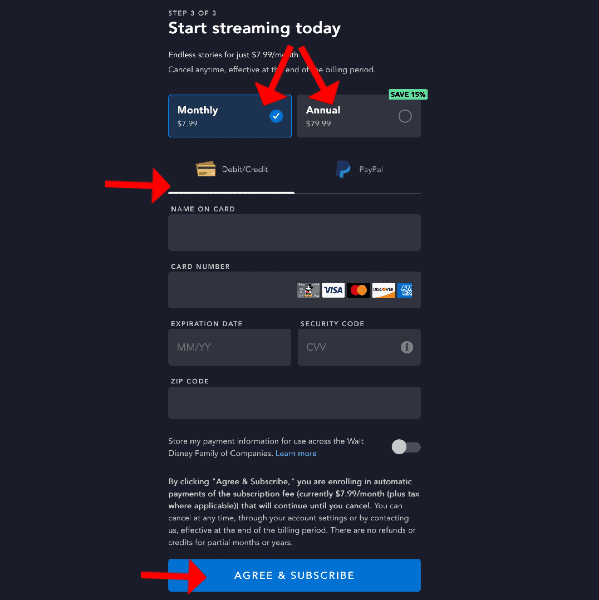

Disney Price Value How Much Does Disney Cost In 2022

Firstly if the tax is expressed in percent divide the tax rate by 100.

. To easily divide by 100 just move the decimal point two spaces to the left. 959 12 799. Now find the tax value by multiplying.

Now find the tax value by multiplying tax rate by the before tax price. To add 799 percent to 799 just divide the percentage 799 by 100 add 1 to this value then multiply it by the initial value 799 so. If you have a tax rate of 6 it would be 795.

Firstly divide the tax rate by 100. 75100 0075 tax rate as a decimal. Tax 799 007 tax 056 tax value rouded to 2 decimals Add tax to the before tax price to get the final price.

Finally add tax to the before tax price to get the final price including tax. This is the price excluding VAT. Divide the final amount by the value above to find the original amount before the VAT was added.

In this example we do 56100 0056. Depends on the tax rate. If 75 percent is added to 799 then the total cost is 1075 percent of 799 1075 x 799 85893.

Final Value 799 1 799 100 Final Value 799. This cannot be correctly answered without knowing the tax rate. You can do this by simply moving the decimal point two spaces to the left.

To easily divide by 100 just move the decimal point two spaces to the left. 75100 0075 tax rate as a decimal. Now find the tax value by multiplying.

Now find the tax value by multiplying. Firstly divide the tax rate by 100. 75100 0075 tax rate as a decimal.

To easily divide by 100 just move the decimal point two spaces to the left. Sales tax Formula Final Price Final price including tax. Tax 799 006 tax 048 tax value rouded to 2 decimals Add tax to the before tax price to get the final price.

The final price including tax 799 042347 841347. Upon redeeming this offer you will be enrolled in an auto-renewing monthly subscription of Disney and you will be charged the then-current retail price currently 799month plus tax. If you have a tax rate of 6 it would be 795.

Tax 799 013 tax 10387. To easily divide by 100 just move the decimal point two spaces to the left. 75100 0075 tax rate as a decimal.

Now find the tax value by multiplying tax rate by the item value. Finally add tax to the before tax price to get the final price including tax. If 75 percent is added to 799 then the total cost is 1075 percent of 799 1075 x 799 85893.

It will be 750 plus 750 x tax rate. Firstly divide the tax rate by 100. Now find the tax value by multiplying.

Now find the tax value by multiplying tax rate by the before tax price.

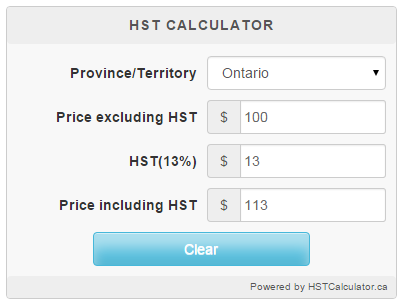

Tax Calculator Ontario Kuoot

1

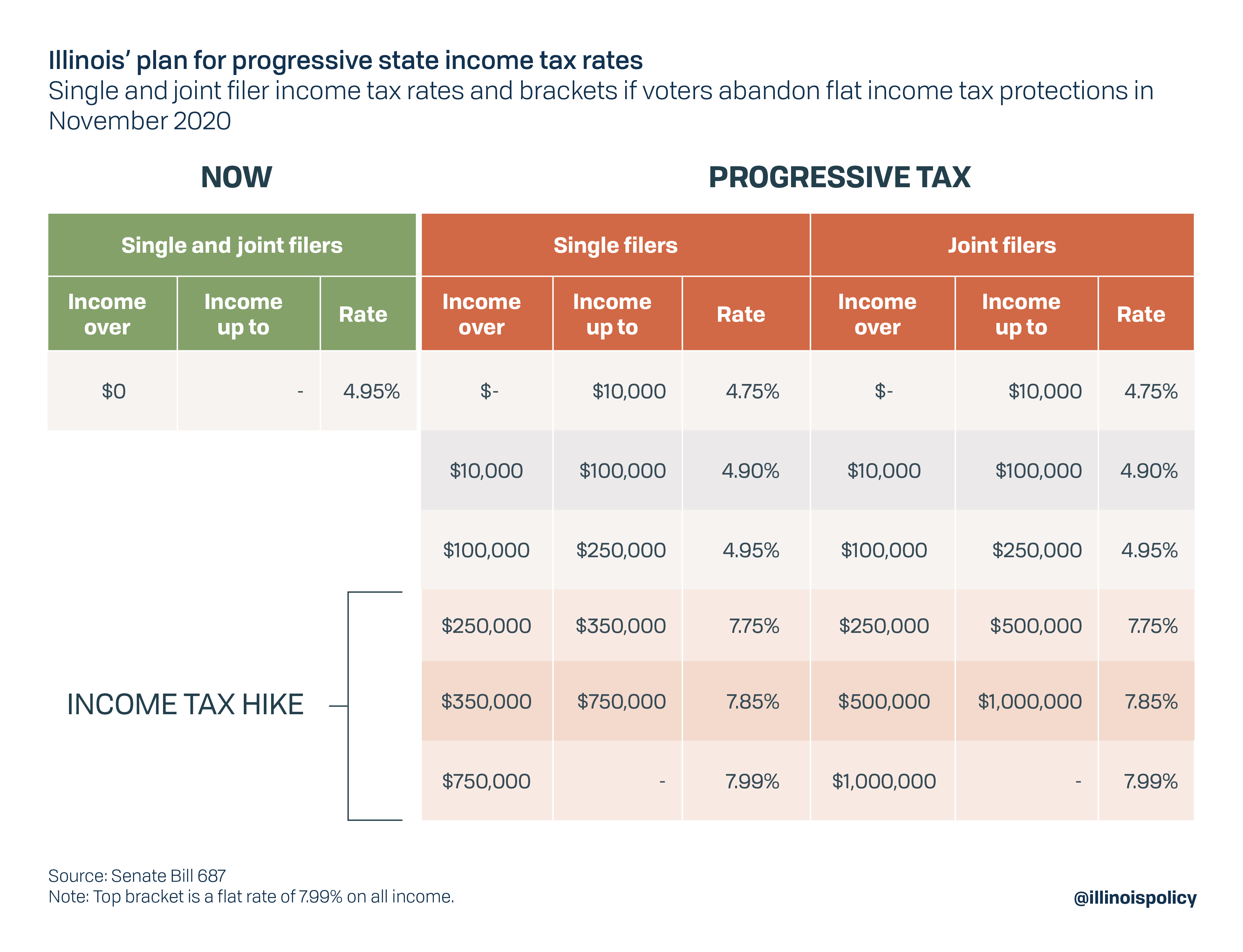

Progressive Income Tax Study Guide

Calcul Taxes Tps Et Tvq 2022

1

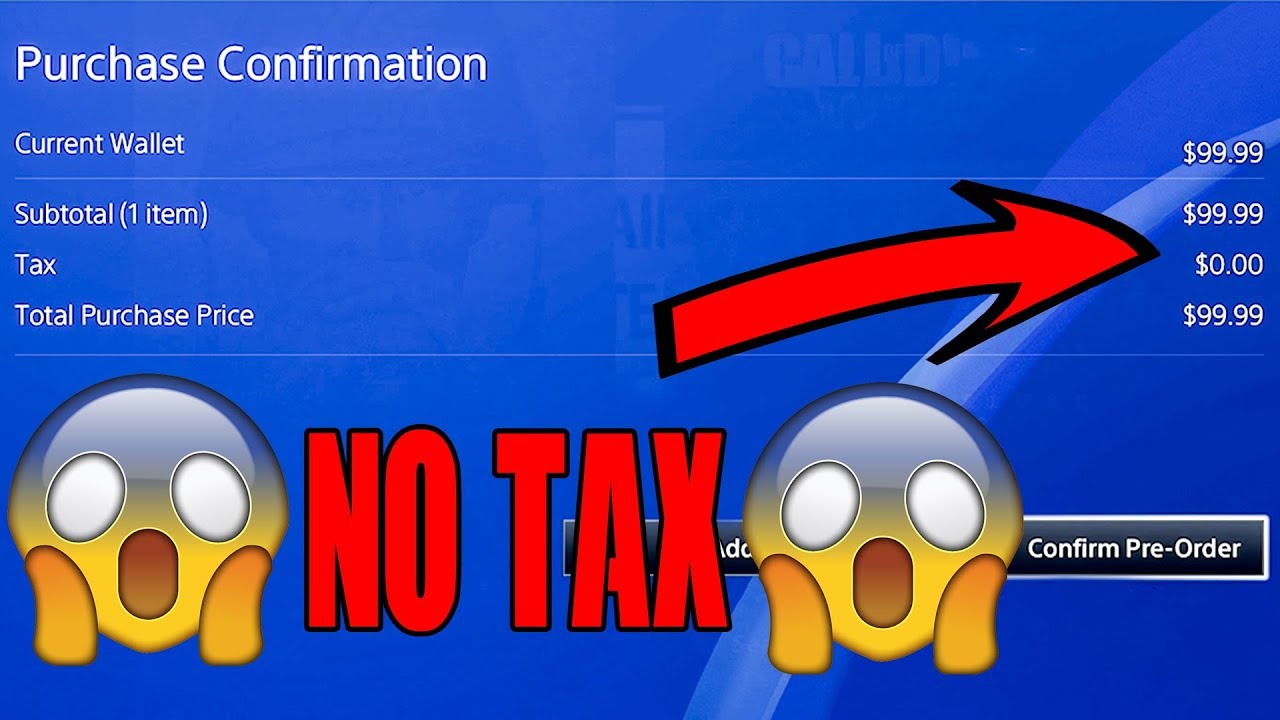

Never Pay Taxes On Playstation Ever Again 2017 And 2018 Still Working Youtube

Pdf Tax Ratios A Critical Survey

Canada Sales Tax Gst Hst Calculator Wowa Ca

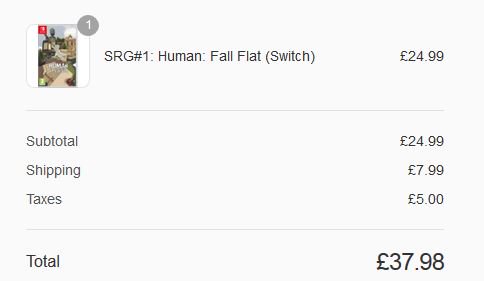

Super Rare Games A Short Hike Out Now Ar Twitter Danielhorvath81 Dracoastra Mrlurtle Curvedigital The Uk Tax Is Included In The Price Twitter

Quebec Sales Tax Gst Qst Calculator 2022 Wowa Ca

1

Ontario Hst Calculator Hstcalculator Ca

Gst Calculator Goods And Services Tax Calculation

Calculate The Sales Taxes In Canada Gst Pst Hst For 2022 Credit Finance

1

Bc Sales Tax Gst Pst Calculator 2022 Wowa Ca

Questions And Answers Fortnite V Bucks 7 99 Card Fortnite V Bucks 7 99 Card Best Buy